VA IRRRL Comparison 2004-2025 free printable template

Show details

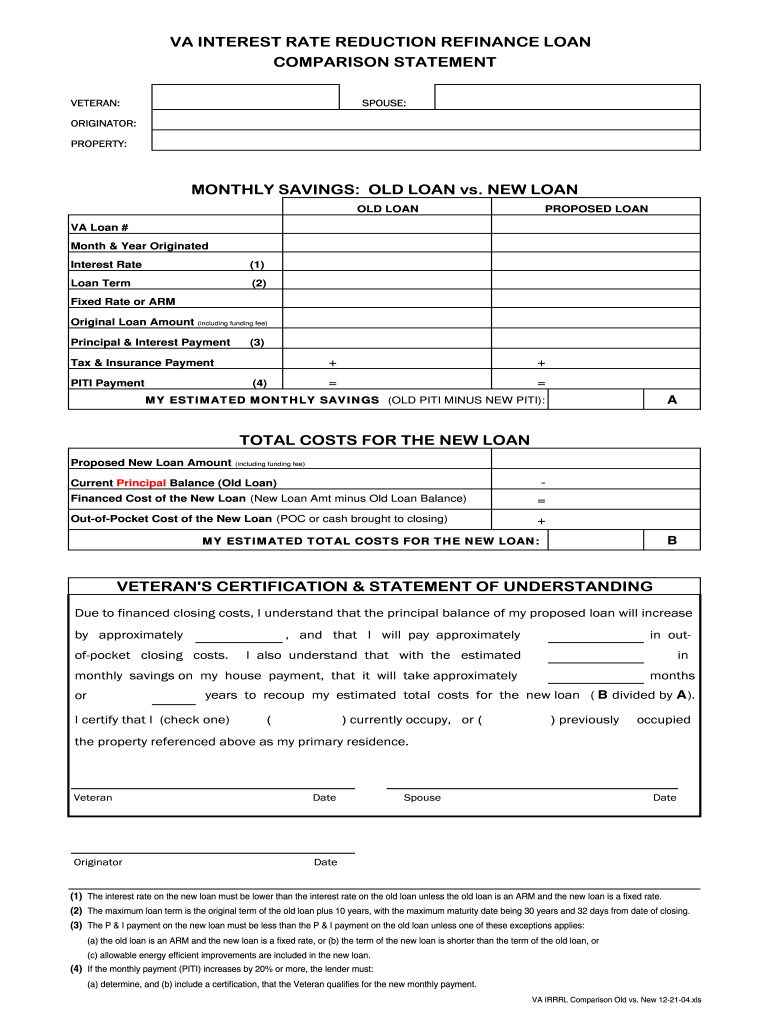

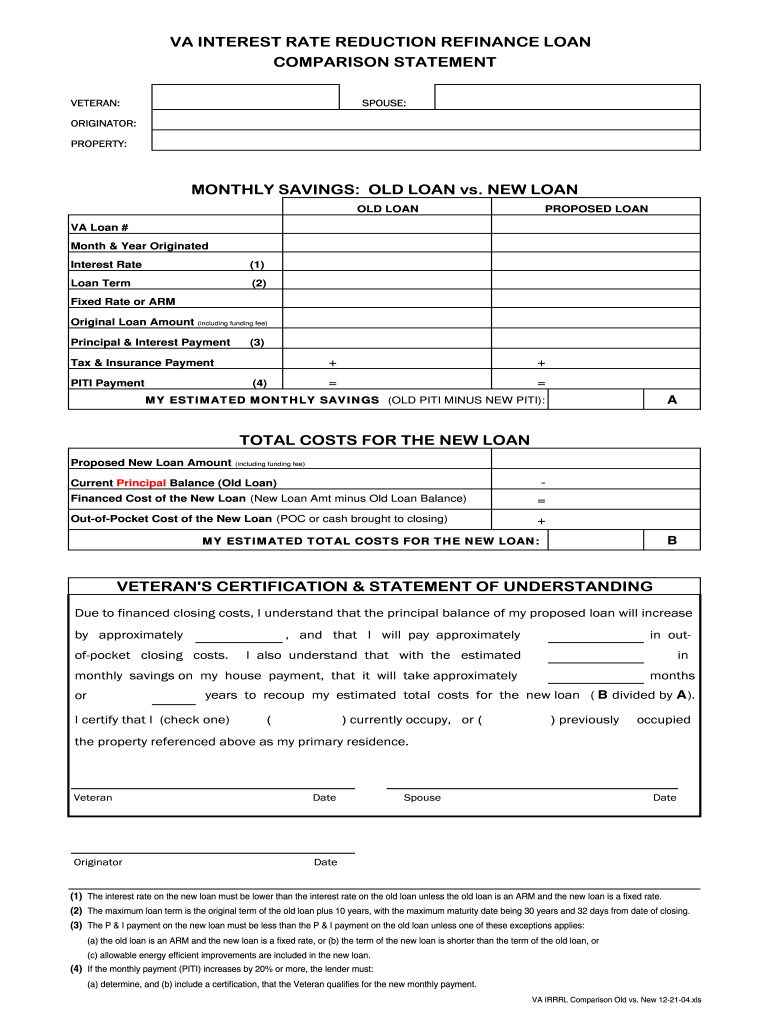

This document provides a comparison statement for veterans considering a VA Interest Rate Reduction Refinance Loan, outlining monthly savings, costs for the new loan, and certification statements.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign va irrrl worksheet fillable pdf form

Edit your best irrrl lenders form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your va loan comparison worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit va interest rate reduction refinancing loan comparison disclosure online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit reduction refinance loan comparison form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out va irrrl form

How to fill out VA IRRRL Comparison

01

Gather your existing loan information, including current interest rate and loan balance.

02

Collect details about the new loan offer, including the interest rate, fees, and terms.

03

Use a VA IRRRL comparison calculator or template to input data for both loans.

04

Compare the monthly payments, interest savings, and overall costs of both loans.

05

Evaluate potential benefits like reduced monthly payments or shorter loan terms.

06

Review your findings with a VA-approved lender to ensure accuracy and discuss options.

Who needs VA IRRRL Comparison?

01

Veterans who currently have a VA loan and are looking to refinance to a lower interest rate.

02

Borrowers who want to make use of the VA Interest Rate Reduction Refinance Loan program.

03

Homeowners seeking to compare the potential savings from refinancing their existing VA loan.

Fill

va loan comparison form

: Try Risk Free

People Also Ask about va irrrl benefit statement

What is loan paperwork called?

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.

How to write a loan form?

Tips For Loan Request Letter Describe the reason for the loan in detail. Be brief and include the relevant details of applying for the loan. Attach the necessary supporting documentation. Identify the amount of money you need. Be polite and professional when addressing the reader.

What is a personal loan a form of?

Personal loans are a form of installment credit. Unlike a credit card, a personal loan delivers a one-time payment of cash to borrowers.

What is a loan form?

A loan application form is a document used by individuals or businesses (especially new businesses) to request a loan from a lender such as a bank or credit union.

What is a personal loan form?

A personal loan agreement outlines the terms of how money is borrowed and when it will be paid back. It is a simple agreement that includes the borrowed amount, interest rate, and when the money must be repaid.

What is 6% interest on a $30000 loan?

For example, the interest on a $30,000, 36-month loan at 6% is $2,856.

What is an example of a loan payment?

For example, if you borrow $100,000 for 30 years at 4.25%, your monthly payment per $1,000 borrowed would be $4.92. Multiply that factor (4.92) by 100 (100,000/1,000) to estimate your monthly payment of $492.00.

What is the final payment of a loan called?

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

Is a loan paid monthly?

Your monthly payment is based on the debt and repayment term. A $5,000 loan paid over five years will have lower monthly payments than a $5,000 loan paid over three years because the payments are spread out over a longer period.

What is loan paid?

Loan Payments: The amount of money that must be paid every month or week in order to satisfy the terms of the loan. Based on the principal, loan term, and interest rate, this can be determined from an amortization table.

How am I supposed to pay off student loans?

The fastest way to pay off student loans could include paying interest while in school, using autopay and making bi-weekly payments. If you can make extra payments toward the principal, that will speed up your debt-free date even more.

How do I repay a loan?

How to Pay Off Debt Faster Pay more than the minimum. Pay more than once a month. Pay off your most expensive loan first. Consider the snowball method of paying off debt. Keep track of bills and pay them in less time. Shorten the length of your loan. Consolidate multiple debts.

How do you pay off student loans?

Pay More than Your Minimum Payment Paying a little extra each month can reduce the interest you pay and reduce your total cost of your loan over time. Continue to make monthly payments even if you've satisfied future payments, and you'll pay off your loan faster.

How hard is it to pay off student loans?

It typically takes between 10 and 30 years to pay off a student loan balance, depending on your loans' interest rates, balance owed, annual income and repayment plan. Your chosen repayment plan greatly influences how long it will take you to eliminate student loan debt.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in va irrrl rates today calculator without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing va irrrl comparison worksheet and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an eSignature for the va irrl worksheet in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your irrrl worksheet and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit irrrl on an Android device?

You can make any changes to PDF files, like va irrrl calculator, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is VA IRRRL Comparison?

The VA IRRRL Comparison is a tool used by lenders to help borrowers understand the differences between their current VA loan and a proposed VA Interest Rate Reduction Refinancing Loan (IRRRL).

Who is required to file VA IRRRL Comparison?

Lenders are required to file a VA IRRRL Comparison when processing a borrower's application for an IRRRL to ensure transparency and help borrowers make informed decisions about refinancing.

How to fill out VA IRRRL Comparison?

To fill out the VA IRRRL Comparison, lenders must provide details such as the current loan terms, proposed loan terms, associated costs, and estimated monthly payments, ensuring that all relevant information is clearly presented for the borrower.

What is the purpose of VA IRRRL Comparison?

The purpose of the VA IRRRL Comparison is to give borrowers a clear understanding of the benefits or drawbacks of refinancing their current VA loan, allowing them to make an informed choice about their mortgage options.

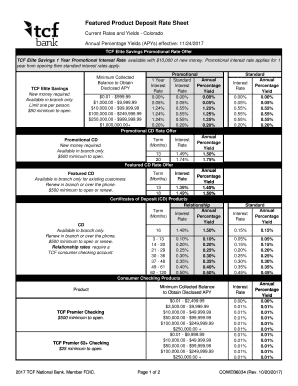

What information must be reported on VA IRRRL Comparison?

The VA IRRRL Comparison must report information such as the current loan's interest rate, balance and payment schedule, the proposed interest rate and payment terms, closing costs, and potential savings over the term of the new loan.

Fill out your VA IRRRL Comparison online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Va Rate Reduction Worksheet is not the form you're looking for?Search for another form here.

Keywords relevant to va interest rate reduction refinance loan irrrl

Related to va interest rate reduction refinance loan

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.