VA IRRRL Comparison 2004-2024 free printable template

Show details

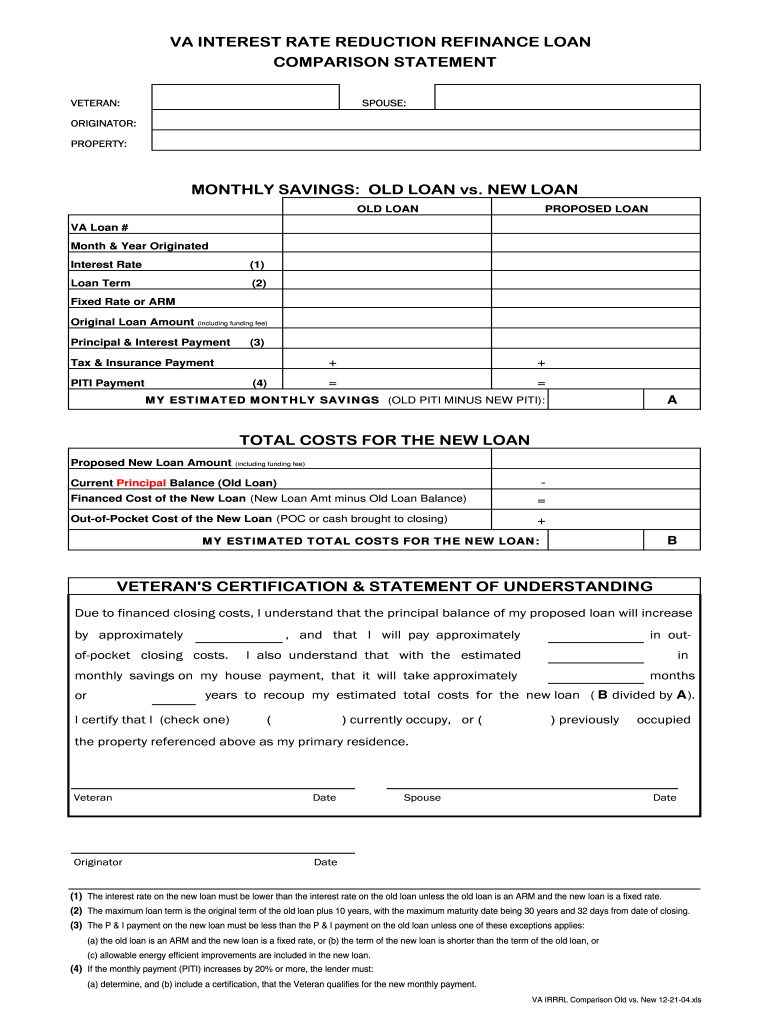

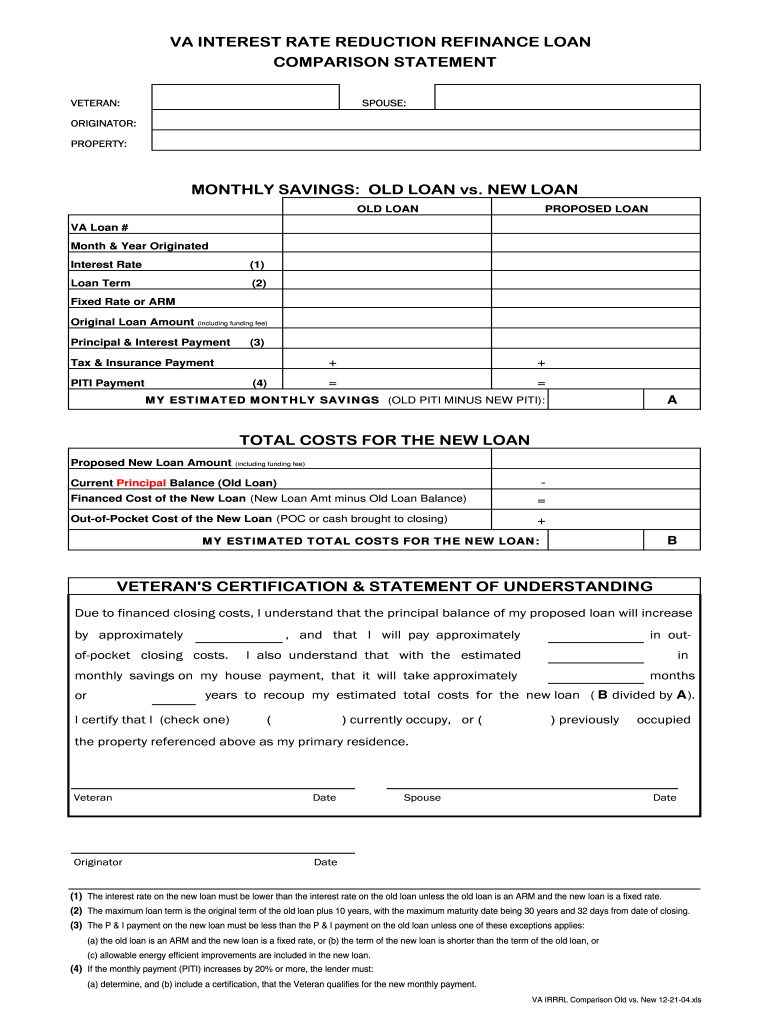

VA INTEREST RATE REDUCTION REFINANCE LOAN COMPARISON STATEMENT VETERAN: SPOUSE: ORIGINATOR: PROPERTY: MONTHLY SAVINGS: OLD LOAN vs. NEW LOAN OLD LOAN PROPOSED LOAN VA Loan # Month & Year Originated

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your va loan comparison form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your va loan comparison form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit va loan comparison online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit loan required form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out va loan comparison form

How to fill out loan paid:

01

Gather all relevant information: Before filling out the loan paid form, make sure to collect all the necessary information, such as the loan account number, the amount being paid, and the payment date.

02

Fill out the borrower's details: Provide the borrower's personal information, including their full name, contact details, and any other required identifying information.

03

Specify the loan details: Indicate the specific loan that is being paid off. This includes providing the loan account number and any additional details that may be required, such as the loan type or purpose.

04

Enter the payment details: Fill in the payment amount, whether it is a partial or full payment, and the date on which the payment is being made. Include any applicable transaction or reference numbers if provided.

05

Sign and date the form: As the person filling out the loan paid form, sign and date the form to confirm its accuracy and to indicate your agreement with the provided information.

Who needs loan paid:

01

Individuals with outstanding loans: Anyone who has borrowed money and is responsible for making loan payments needs to fill out the loan paid form.

02

Borrowers who have made full or partial payments: Whether a borrower has paid off the entire loan amount or has made partial payments towards the loan, they need to fill out the loan paid form to formally notify the lender about the payment.

03

People looking to close their loan account: If a borrower wishes to close their loan account and has made the necessary payments, they will need to fill out the loan paid form to initiate the account closure process and provide documentation of the payment.

Fill comparison form fillable blank : Try Risk Free

People Also Ask about va loan comparison

What is loan paperwork called?

How to write a loan form?

What is a personal loan a form of?

What is a loan form?

What is a personal loan form?

What is 6% interest on a $30000 loan?

What is an example of a loan payment?

What is the final payment of a loan called?

Is a loan paid monthly?

What is loan paid?

How am I supposed to pay off student loans?

How do I repay a loan?

How do you pay off student loans?

How hard is it to pay off student loans?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the penalty for the late filing of loan paid?

The penalty for the late filing of a loan paid can vary depending on the specific terms and conditions of the loan agreement. Typically, late payment penalties are outlined in the loan agreement or contract, and they may include additional interest charges, late fees, or a negative impact on the borrower's credit score. It is important to review the loan agreement to understand the specific penalties that may be imposed for late filing.

What is loan paid?

Loan paid refers to the repayment of a loan, where the borrower returns the borrowed funds to the lender. This typically includes paying off the principal amount borrowed, as well as any interest or fees associated with the loan. Loan repayment can be done in installments over a specific period of time, according to the terms and conditions of the loan agreement. The borrower is obligated to fulfill the repayment schedule until the entire loan amount is paid back.

Who is required to file loan paid?

The person or entity required to file a loan paid depends on the specific circumstances and regulations of the country or jurisdiction. In general, it is the borrower who is responsible for repaying the loan. However, lenders or financial institutions may also be required to keep records and file reports regarding the loans they provide. Additionally, both borrowers and lenders may need to report loan payments to tax authorities for various purposes such as deductibility of interest or meeting reporting requirements. It is advisable to consult with a financial professional or refer to local laws and regulations to determine the specific obligations related to filing loan payments in a particular context.

How to fill out loan paid?

To properly fill out a loan payment form, follow these steps:

1. Identify the form: Determine the specific loan payment form you need to fill out. It could be a paper form provided by your lender or an online form on their website.

2. Provide personal information: Fill in your personal details such as your full name, address, and contact information. Include any account numbers or identifiers specified on the form.

3. Specify the loan details: Enter the necessary information about the loan for which you are making a payment. This may include the loan number, loan type, and the amount you borrowed.

4. Indicate the payment amount: Write down the precise amount you are paying towards the loan. Make sure to enter the payment date if required.

5. Choose the payment method: Specify the payment method you used, such as cash, check, debit card, or online transfer. Include any related details, such as check number or transaction reference number.

6. Sign and date the form: If applicable, sign and date the form to acknowledge that the information you provided is accurate and complete.

7. Retain a copy: Keep a copy of the filled-out form for your records. This will serve as proof of payment and as a reference in case of any discrepancies in the future.

Note that the specific fields and steps may vary depending on the lender and the form you are using to make the loan payment. Therefore, it is crucial to carefully review and follow the instructions provided on the loan payment form.

What is the purpose of loan paid?

The purpose of a loan being paid off is for the borrower to fulfill their financial obligation to the lender. When a borrower makes loan payments, it allows them to gradually repay the borrowed amount along with any applicable interest and fees. Once the loan is fully paid off, the borrower no longer owes any outstanding debt to the lender. Additionally, paying off a loan can help improve the borrower's credit score and financial situation, as it demonstrates responsible financial management.

What information must be reported on loan paid?

When a loan is fully paid off, the following information should be reported:

1. Borrower's Information: The full name, address, contact details, and identification number (such as social security number or tax identification number) of the borrower.

2. Lender's Information: The full name, address, and contact details of the lender or lending institution.

3. Loan Details: The loan account number, the original loan amount, the date when the loan was taken, and the date when the loan was fully paid off.

4. Payment Details: The total amount paid to fully repay the loan, the payment method used (e.g., check, electronic transfer), and the date of the final payment.

5. Interest Information: If applicable, any interest paid on the loan should be reported separately, with details such as the interest rate, total interest paid, and any interest adjustments made.

6. Prepayment Penalties (if any): If there were any prepayment penalties associated with the loan, these should be mentioned and detailed separately.

7. Title or Collateral Release: If the loan was secured by collateral, such as a vehicle or property, information about the release of the title or the collateral should be reported.

8. Legal Documentation: Any legal or official documents related to the loan, such as the loan agreement or promissory note, should be kept and reported as part of the loan paid-off process.

Overall, the information reported on a paid-off loan should provide a comprehensive record of the borrower, lender, loan details, payments made, and any relevant legal documentation.

How do I make edits in va loan comparison without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing loan required form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an eSignature for the loan purchase in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your irrrl worksheet and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit loan paid on an Android device?

You can make any changes to PDF files, like va irrrl comparison worksheet form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your va loan comparison form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Purchase is not the form you're looking for?Search for another form here.

Keywords relevant to yes required form

Related to rate reduction statement form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.